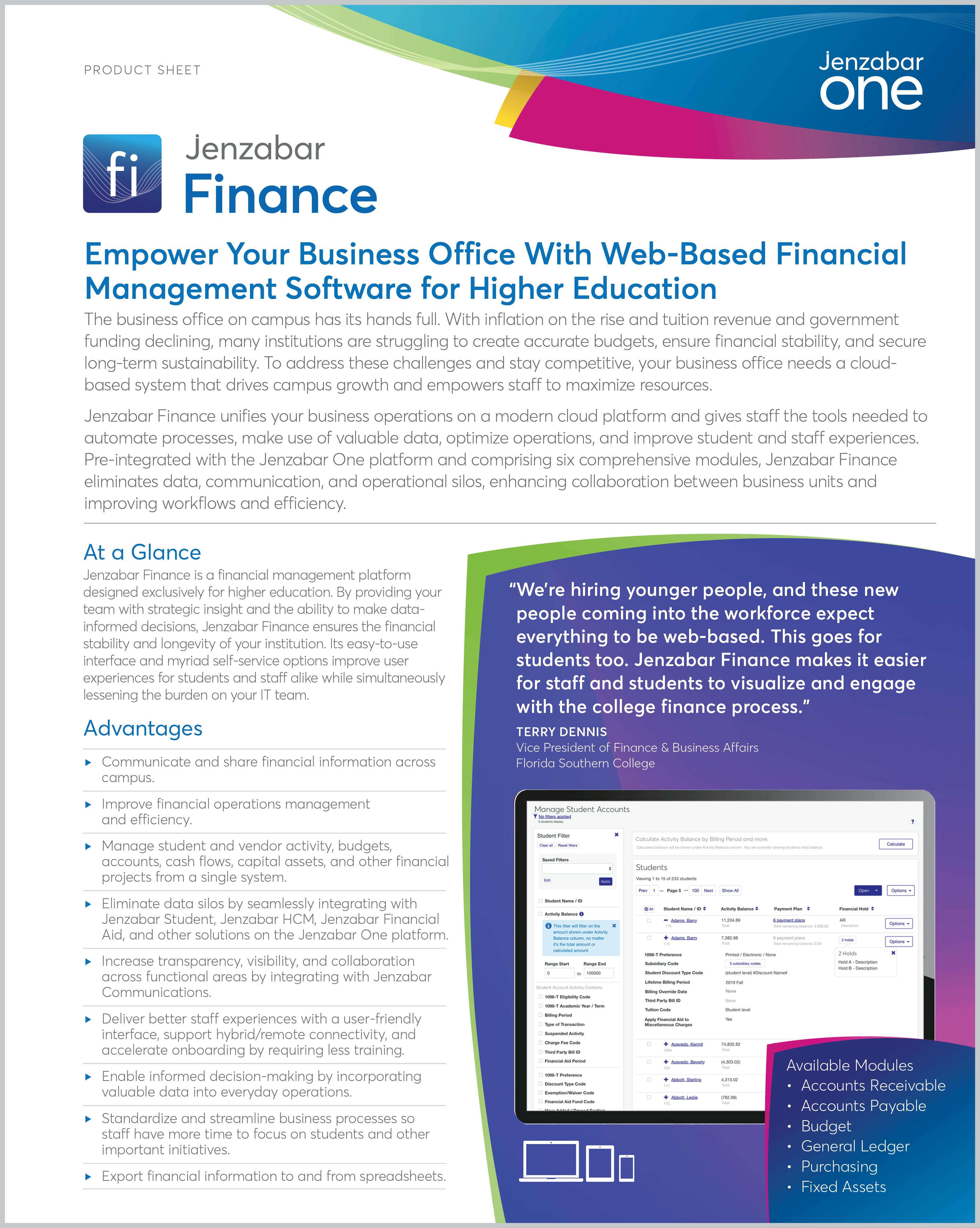

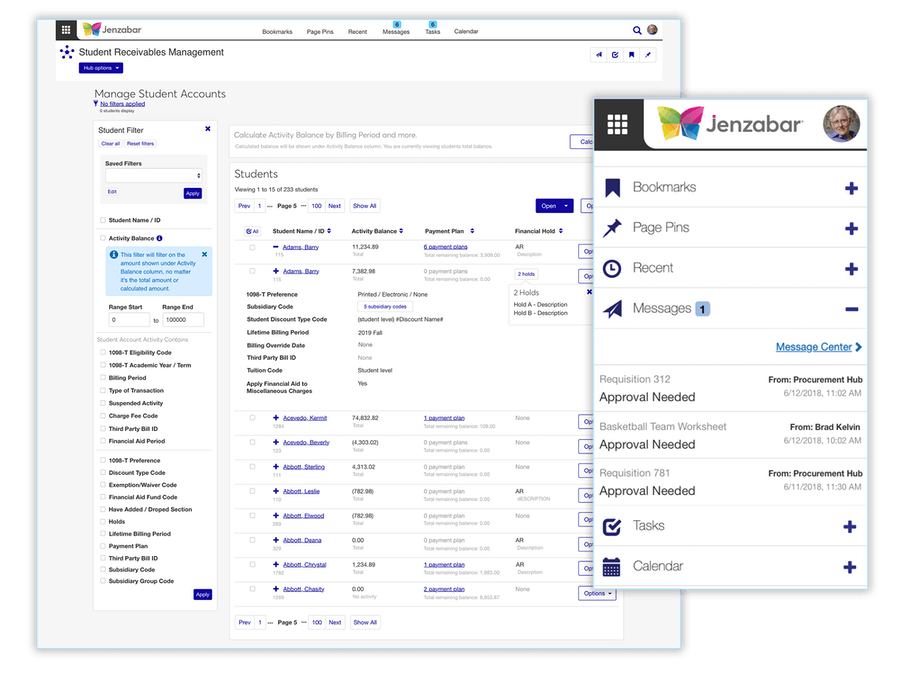

Jenzabar Finance is a financial management platform designed exclusively for higher education. By providing your team with strategic insight and the ability to make data-informed decisions, Jenzabar Finance ensures the financial stability and longevity of your institution. Its easy-to-use interface and myriad self-service options improve user experiences for students and staff alike while simultaneously lessening the burden on your IT team.

Jenzabar Finance Product Sheet

At a Glance

Advantages

- Communicate and share financial information across campus.

- Improve financial operations management and efficiency.

- Manage student and vendor activity, budgets, accounts, cash flows, capital assets, and other financial projects from a single system.

- Eliminate data silos by seamlessly integrating with Jenzabar Student, Jenzabar HCM, Jenzabar Financial Aid, and other solutions on the Jenzabar One platform.

- Increase transparency, visibility, and collaboration across functional areas by integrating with Jenzabar Communications.

- Deliver better staff experiences with a user-friendly interface, support hybrid/remote connectivity, and accelerate onboarding by requiring less training.

- Enable informed decision-making by incorporating valuable data into everyday operations.

- Standardize and streamline business processes so staff have more time to focus on students and other important initiatives.

- Export financial information to and from spreadsheets

Terry Dennis

Vice President of Finance & Business Affairs

Florida Southern College

Promote Institutional Success and Stability With Jenzabar Finance

Jenzabar Finance is a modern financial management system designed to deliver seamless experiences and empower your business office to make informed decisions that will lead to long-term success, stability, and growth. Jenzabar Finance is comprised of six fully integrated modules: General Ledger, Budget, Accounts Payable, Accounts Receivable, Purchasing, and Fixed Assets.

Accounts Receivable

Boost student enrollment and retention and help collect more tuition revenue by offering students and parents improved self-service experiences. The Accounts Receivable module gives students the ability to view account details and sign up for convenient auto/recurring payment plans, and it enables parents to pay bills through the parent portal. The online payment experience enables credit card convenience fees, which means institutions no longer have to cover those fees themselves when students or parents pay by credit card.

- Uncomplicate processes by allowing administrators to sign students up for payment plans, including auto/recurring payment plans.

- Easily maintain and track all activity, including charges and payments on student accounts.

- Allow students to sign up for or auto-enroll in a payment plan based on predefined criteria, helping to ensure the collection of tuition revenue.

- Eliminate school-covered processing fees with an online payment experience that enables credit card convenience fees.

- Minimize data entry errors from staff by allowing students to input bank information for electronic funds.

- Publish account statements and 1098-T documents to the student/parent portal.

- Create customizable searches to quickly and easily find student accounts, perform batch actions upon those accounts (such as applying a financial hold if a balance is due), and export that data directly to Microsoft Excel.

- Customize charge and refund rules based on your institution’s requirements and bill students either at a flat rate or per hour for tuition and fees.

- Integrate with Jenzabar Communications to improve collaboration with students regarding their financial accounts, payment plans, past due balances, and more.

Accounts Payable

Gain increased control over your institution’s critical financial information. Jenzabar Finance’s Accounts Payable module makes it easier to manage cash flow and vendor activity by tracking and verifying compliance with each transaction. Optimize daily cash flow and develop stronger vendor relationships by more efficiently managing invoices and processing payments.

- Improve efficiency with less chance for error by setting up automated recurring payment entries.

- Enable multiple line entries for invoices.

- Maintain all vendor profiles and summaries in a single system.

- Easily process vendor payments via paper check or electronically using our ACH payment processing.

- Support reporting for 1099-MISC, 1099-INT, 1099-Q, 1099- NEC, and 1099-R forms.

- Automatically generate student refund payments for students with credit balances.

- Attach supporting documentation to vendors and invoices.

- Enable users to see and match all documents throughout the procurement flow process, from requisition to purchase order to invoice and payment.

Budget

Empower your staff, make financial planning more efficient and transparent, and exceed your institutional goals. Jenzabar Finance’s Budget module provides staff with a secure, comprehensive approach to budgeting and—by allowing integrated and collaborative budget creation and consolidation—makes it easier than ever to manage and control your institution’s financial plans. Set up access and workflows that work for your department and automate notifications to keep everyone up to date.

- Create more accurate budgets by drilling down into historic spending trends.

- Keep staff updated on changes with automated, preloaded notification events.

- Maximize accuracy through electronic approvals and clear audit trails.

- Offer staff secure remote access to highly sensitive data.

- Enable more flexible budgeting across campus by allowing unlimited report variations.

- Break down budgeting by department to maximize campus input and buy-in.

- Integrate with Jenzabar Communications to expand collaboration during budget prep.

- Adapt to unexpected budgetary changes using a flexible adjustment approval process.

General Ledger

Gain complete control over your institution’s financial activity. The General Ledger module allows you to quickly track and manage your financial information. Easily access operational activity using intuitive navigations, clearly defined subledger journal entries, extensive audit trails, system-wide data imports/exports, balance drilldowns to details, drill-across to associated operational data, enhanced information architecture, and more.

With Jenzabar Finance’s General Ledger, you can record financial activity anywhere on your campus, create a complete record of your institution’s financial transactions, and analyze your financial information to improve efficiency, enhance transparency, and reduce costs.

- Update General Ledger balances immediately and in real time.

- Prepare and produce financial statements.

- Automatically generate recurring journal entries.

- Track student and vendor account details through subledgers.

- Improve financial planning by analyzing unlimited prior year transactions.

- Automatically calculate sub-ledgers.

- Easily submit and track year-end closing and balance forward entries.

- Track, budget, and report on any school-defined project.

Purchasing

Improve how you track purchases, increasing productivity and decreasing error rates. The Purchasing module enables you to track all purchases—for any department— throughout your institution. It also charges purchase orders and requisitions to various departments and automatically tracks those orders—freeing staff to focus on other critical projects.

- Unburden staff by automating the process for creating purchase orders upon final requisition approval.

- Streamline operations and keep staff up to date with enhanced notifications and collaborative purchasing workflows.

- Automatically assign approval tracks upon requisition creation using a rules-based process.

- Support various shipping locations.

- Easily search for email purchase orders or check on statuses in one system.

- Enable users to export requisition and purchase order information to Microsoft Excel.

- Enable staff to submit orders and then flag items from their orders as received through an online, user-friendly experience.

- Accelerate processing and streamline the procurement flow by allowing approvers to approve, deny, or return requisitions to the original requestor online.

- Request and attach supporting documentation to the requisition or purchase order to eliminate questions that slow down the procurement process.

Fixed Assets

Manage the fixed asset lifecycle from acquisition to disposal, while efficiently maintaining and processing the depreciation of assets. The Fixed Assets module is a fully integrated accounting and management environment that allows you to manage assets, track depreciation, and centralize reporting. Easily transfer asset information from Accounts Payable invoices and transfer depreciation entries to General Ledger accounts.

- Enable a flexible depreciation expense process by allowing staff to determine which assets to depreciate and how often the process should be run.

- Enhance projected financial depreciation expenses by forecasting future depreciation through various scenarios.

- Easily track construction in progress (CIP) by invoice or vendor.

- Centrally manage the entire fixed asset lifecycle, from review, CIP, depreciation, non-depreciation, asset sale, and retirement.

- Reduce manual work by providing staff with comprehensive, ready-to-use reports.

- Improve reporting by detailing transactions for invoices posted to assets, as well as for service histories, improvements, purchase information, and notes.

- Improve security by building custom groups for classes and departments.